|

|

|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding FHA Loan Requirements in Oklahoma: Key ConsiderationsWhen contemplating the journey of homeownership in Oklahoma, understanding the intricacies of FHA loans becomes imperative. These government-backed mortgages, designed to assist first-time homebuyers and those with limited financial resources, are characterized by more lenient qualification requirements compared to conventional loans. As you embark on this endeavor, it is essential to grasp the specific prerequisites and implications of FHA loans within the Sooner State. First and foremost, prospective borrowers must meet certain credit score requirements. While the FHA sets a minimum credit score of 500, lenders typically prefer a score of at least 580 to qualify for a lower down payment of 3.5%. In Oklahoma, where the real estate market is both diverse and dynamic, maintaining a healthy credit profile is crucial.

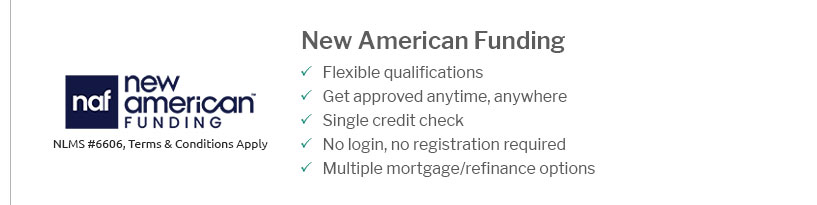

It is noteworthy to consider the Mortgage Insurance Premiums (MIP) associated with FHA loans. These premiums, while providing insurance for the lender, increase the overall cost of the loan and remain for the life of the loan if the down payment is less than 10%. For many Oklahomans, the decision to go with an FHA loan involves weighing these costs against the benefits of lower initial barriers to homeownership. Lastly, while FHA loans offer a viable path to owning a home in Oklahoma, they require careful consideration of one's financial situation and long-term goals. Consulting with a knowledgeable mortgage advisor can provide personalized insights into whether this loan type aligns with your aspirations. Ultimately, while the FHA loan is a valuable tool, ensuring it fits your unique needs is paramount for a successful homebuying experience. https://www.newamericanfunding.com/loan-types/fha-loan/state/oklahoma/

To qualify for an FHA loan in Oklahoma, borrowers need to have a minimum credit score of 500 but may be required to have a larger down payment. https://www.fha.com/lending_limits_state?state=Oklahoma

Credit Score Requirements as Low as 580. FHA loans are the #1 loan type in America for first-time homebuyers. Many people who can ... https://www.lendingtree.com/home/fha/fha-loan-limits-in-oklahoma/

How to qualify for an FHA loan in Oklahoma - Minimum 500 to 580 credit score: A credit score of at least 580 is required to make a 3.5% down payment. - Proof of ...

|

|---|